The Impact of Network Congestion on Fees

Bitcoin transaction fees are directly influenced by the level of network congestion. High levels of activity on the Bitcoin network lead to increased competition for block space, driving up transaction fees. Understanding this dynamic is crucial for users seeking to minimize their costs.

Network congestion arises when the number of pending transactions exceeds the network’s capacity to process them within a reasonable timeframe. This is primarily determined by the block size and the rate at which miners add blocks to the blockchain. As more users attempt to send transactions simultaneously, miners prioritize those offering higher fees, creating a competitive bidding system for block inclusion.

The Relationship Between Pending Transactions and Fee Levels

The number of unconfirmed transactions waiting to be included in a block is a key indicator of network congestion and directly impacts transaction fees. A high number of pending transactions signifies intense competition for block space. Miners, acting rationally, will prioritize transactions with higher fees, ensuring their profitability. Consequently, users are compelled to offer higher fees to guarantee timely transaction processing. This creates a direct correlation: more pending transactions equate to higher fees. A visual representation would show a graph with the x-axis representing the number of pending transactions and the y-axis representing the average transaction fee, illustrating a clear upward trend.

The Impact of Block Size Limitations on Transaction Fees

Bitcoin’s block size limit is a fundamental factor influencing network congestion and transaction fees. Currently capped at 1 MB, this limitation restricts the number of transactions that can be included in each block. When the number of transactions surpasses the block’s capacity, a backlog develops, leading to increased congestion and higher fees. Increasing the block size would theoretically increase the network’s capacity to process transactions, potentially reducing congestion and fees. However, debates around increasing the block size continue, balancing scalability with potential security and decentralization concerns.

A Scenario Illustrating Congestion’s Impact on Fees

Imagine a scenario where a major cryptocurrency exchange experiences a surge in trading volume. This leads to a massive influx of Bitcoin transactions, far exceeding the network’s capacity. The mempool (the pool of unconfirmed transactions) rapidly fills, and the average transaction fee skyrockets. Users attempting to send transactions during this period find themselves forced to pay significantly higher fees to ensure their transactions are included in a block within a reasonable timeframe. For instance, a transaction that normally costs a few cents might cost several dollars during such periods of peak congestion. This scenario highlights the direct link between network congestion and the volatility of Bitcoin transaction fees.

Advanced Techniques for Fee Optimization

Optimizing Bitcoin transaction fees requires a nuanced understanding beyond simply selecting a suggested fee. Several advanced strategies can significantly reduce costs, especially during periods of network congestion. These techniques involve leveraging different wallet functionalities, strategic transaction batching, and a careful consideration of Replace-by-Fee (RBF).

Wallet Selection and Fee Management, Understanding Bitcoin transaction fees and how to minimize them.

Different Bitcoin wallets offer varying levels of control over transaction fees. Some wallets provide only basic fee suggestions, while others allow for manual fee adjustments, offering granular control over the speed and cost of your transaction. Wallets like Electrum, for example, provide users with a visual representation of the current network congestion and offer the option to choose a custom fee, enabling users to balance transaction speed with cost-effectiveness. In contrast, simpler wallets may only offer pre-set fee options, limiting the user’s ability to optimize fees. Choosing a wallet that allows for manual fee adjustments is crucial for those aiming to minimize transaction costs.

Transaction Batching

Batching multiple transactions into a single transaction can substantially reduce fees. Instead of sending several small transactions individually, combining them into one reduces the overall number of transactions on the blockchain. This method reduces the amount of data that needs to be processed and verified, thereby lowering the total transaction fee. For example, instead of sending five separate payments of 0.001 BTC each, combining them into a single transaction of 0.005 BTC will result in a lower overall fee than the sum of the individual transactions’ fees. The savings become more pronounced with a larger number of smaller transactions.

Replace-by-Fee (RBF)

Replace-by-Fee (RBF) allows users to replace a previously broadcast transaction with a new one offering a higher fee. This is particularly useful when a transaction is stuck in the mempool due to low fees. By increasing the fee, the transaction is prioritized for inclusion in the next block, ensuring faster confirmation. However, RBF has drawbacks. It requires the receiving party to be using a wallet compatible with RBF, and it can lead to a slight increase in the total fee paid if the initial fee was significantly underestimated. Moreover, repeated use of RBF can be seen as undesirable behavior by miners, potentially affecting transaction processing in the long run. Therefore, careful consideration is necessary before employing RBF.

Case Study: Fee Optimization Strategies Compared

Let’s consider a scenario where a user needs to send three transactions, each involving 0.001 BTC.

- Scenario 1: Using a basic wallet with default fees: Assume a default fee of 0.0001 BTC per transaction. The total fee would be 0.0003 BTC.

- Scenario 2: Manual fee adjustment with a more advanced wallet: By carefully selecting a lower fee during periods of low network congestion, the user might achieve an average fee of 0.00005 BTC per transaction, resulting in a total fee of 0.00015 BTC.

- Scenario 3: Batching transactions: Combining the three transactions into a single transaction could result in a fee of 0.00012 BTC, even during periods of higher network congestion.

This simple example demonstrates that strategic fee management and transaction batching can lead to significant savings compared to using default fees. The optimal strategy depends on the specific circumstances, including the urgency of the transaction and the network’s congestion level. The use of RBF would only be relevant if a transaction in any of these scenarios became stuck.

Tools and Resources for Monitoring Bitcoin Fees: Understanding Bitcoin Transaction Fees And How To Minimize Them.

Navigating the world of Bitcoin transactions requires a keen understanding of transaction fees. These fees, paid to miners for processing transactions, fluctuate based on network congestion and demand. To make informed decisions and minimize costs, utilizing reliable fee estimation tools is crucial. These tools provide real-time data, enabling users to optimize their transaction fees and ensure timely confirmations.

Knowing the current fee landscape is paramount to avoid delays or excessively high costs. Several websites and tools offer this critical information, each with its own strengths and weaknesses. Choosing the right tool depends on individual needs and technical proficiency.

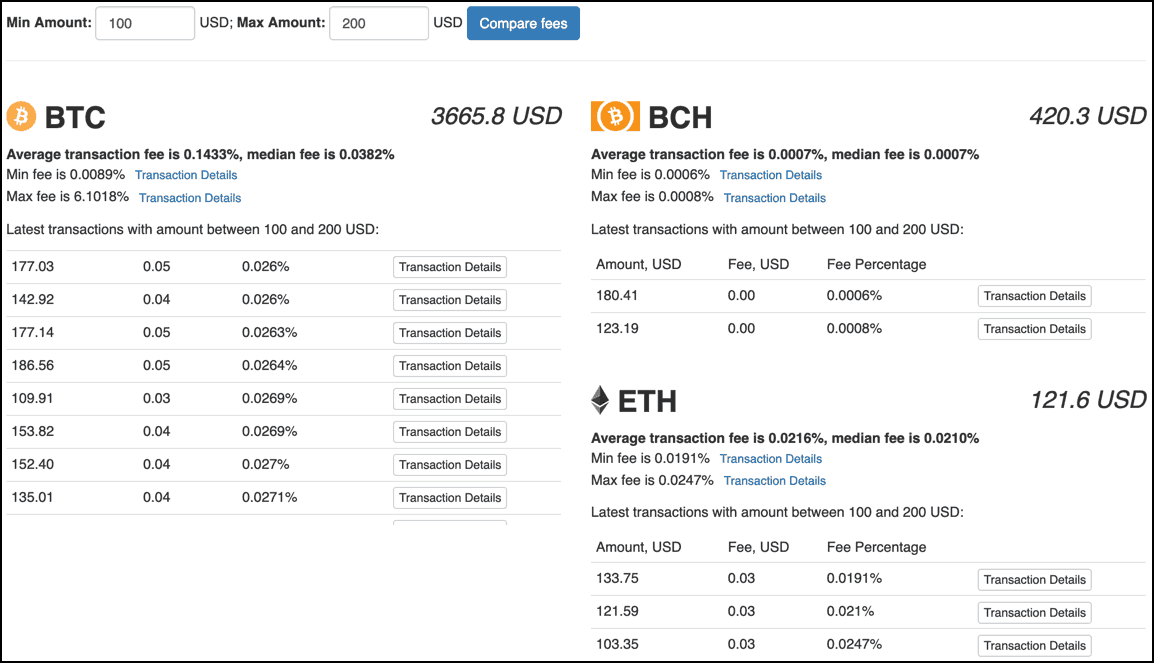

Bitcoin Fee Estimation Tools

Several services offer real-time Bitcoin fee estimates. These tools analyze the current mempool (the pool of unconfirmed transactions) and predict the fee necessary for timely transaction confirmation. The information they provide typically includes suggested fees for different confirmation times (e.g., fast, medium, slow). This allows users to balance speed and cost based on their urgency.

| Tool Name | Features | Accuracy | Ease of Use |

|---|---|---|---|

| Mempool.space | Real-time mempool visualization, fee estimates for various confirmation times, transaction propagation tracking. | High, based on direct mempool observation. | High, user-friendly interface with clear data presentation. |

| BitcoinFees.io | Fee estimates for different confirmation targets, historical fee data, charts illustrating fee trends. | High, uses a robust algorithm based on historical and real-time data. | Medium, slightly more technical than Mempool.space but still accessible. |

| Blockchain.com | Fee estimates integrated into their transaction creation interface, simple and intuitive. | Medium, provides a reasonable estimate but might not reflect the most granular mempool dynamics. | High, very easy to use, especially for less technical users. |

| FeeEstimate.com | Offers fee estimates for various confirmation times, providing both average and priority fees. | Medium to High, depending on the accuracy of their underlying data sources. | Medium, functionality is straightforward but requires some understanding of fee structures. |

The accuracy of fee estimates can vary depending on network conditions. During periods of high congestion, fees can spike unexpectedly, even with real-time tools. It’s always prudent to err on the side of caution and include a slight buffer in your chosen fee to ensure timely confirmation. For example, if a tool suggests a fee of 1 satoshi per byte for a fast confirmation, adding an extra 1 or 2 satoshis per byte can significantly reduce the risk of delays. Using multiple tools to compare estimates can further improve your decision-making process.